The Sports Apparel Nightmare

8 minute read · Issue Number 127 · July 1st, 2022

Companies within sports apparel have been heavily challenged this year, mostly due to rising inflation and struggling supply chains worldwide.

This week, Nike reported their latest financial earnings – providing a glimpse into how business is going.

Let’s take a look:

Nike’s Performance

Year to date (YTD), Nike has underperformed the market (i.e., relative to the S&P 500 Index). Nike has dropped 37%, while the market is down only 20%.

Nike reported earnings Monday, and the stock has been down about 7%.

Companies move after earnings because investors learn about the company's performance and adjust their future expectations.

The earnings will tell us why.

The Earnings

Nike's earnings reported the fourth quarter (ending May 31st) and the full fiscal year, and two things stand out– revenues and inventories.

Revenues

Nike reported $46.7 billion in full-year revenue – representing a 5% increase.

For the quarter ending May 31st, Nike reported revenues of $12.2 billion, down 1% from the prior-year period, and earnings of $0.90 per share (down 3%).

Even though gross margins were up for the full year, margins for the quarter were down 80 basis points.

Their explanation?

“Primarily due to higher inventory obsolescence reserves in China, elevated freight and logistics costs.”

Full-year revenues for the Nike Brand were $44.4 billion, up 5 percent. Footwear was up 4%, apparel was up 5%, and equipment was up 18%. However, for the quarter, footwear didn’t change, apparel decreased by 6%, and equipment only grew by 10%.

What does all this mean?

The full fiscal year of Nike closed with an increase of 5%. Yet, sales contracted the last quarter by 1% compared to the year before. Meaning – the average growth of the first three quarters was good enough to support the last quarter's contraction. Nevertheless, this is actual proof that Nike actually struggled this previous quarter and that this struggle will likely be pulled forward for the rest of 2022.

Now here’s where it gets interesting:

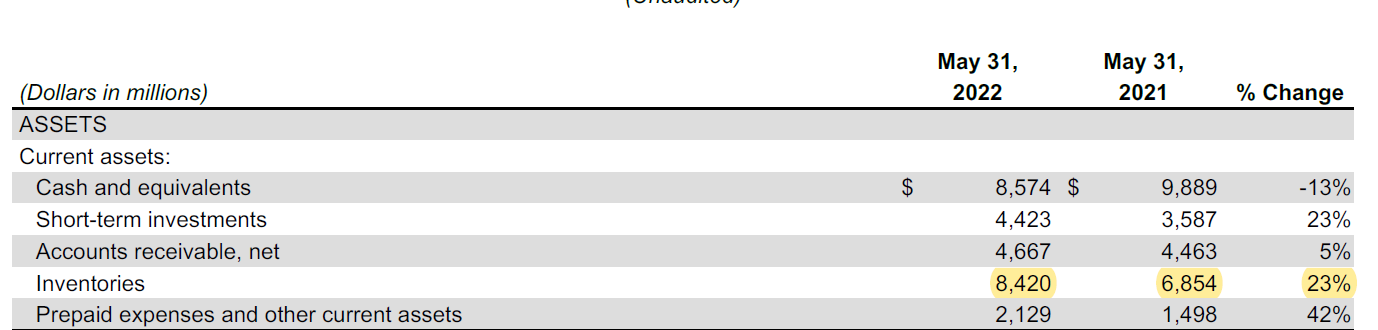

Inventories

Nike’s inventories (i.e., unsold merchandise sitting in a warehouse) grew 23% YoY.

Think about that for a second.

Nike couldn’t sell 23% more of what they’ve produced the full year.

How do they explain this?

“Elevated in-transit inventories due to extended lead times from ongoing supply chain disruptions.”

“Elevated ocean freight and logistics costs continue to dampen near-term profitability in North America.”

“With extended lead times causing in-transit inventory to be 65% of our total inventory at the end of the quarter. Wholesale revenue declined 12% due to inventory supply constraints.”

During the earnings call, Nike’s executives also explained they noticed negative momentum against their highest-growing products, mainly driven by high inflation, near-term economic growth, and consumer demand.

What does it mean?

Nike had the same problem Target and Walmart reported on inventory overload. Earlier this year, companies scrambled to produce and stock their stores with products.

The problem?

Consumption habits from people changed, but not how retailers expected.

Additionally, most of what’s not being sold are ‘in-transit inventory’ – products that haven’t even made it to the stores.

The Bottom Line

Sports apparel has struggled with both the supply and the demand.

The war in Europe, raw material scarcity, and Covid lockdowns threatened the supply chains, leading to firms having inventory overload stuck “in-transit.”

With higher interest rates and product price spikes, the sports consumer is substituting high-end brands for more low-end goods, reducing overall demand.

With too much inventory, Nike will have to sell products at a discount– decreasing margins and earnings.

In short, Nike’s stock reflects the story of the nightmare of sports apparel.

But the good news?

This could lead to inflation coming down faster than expected.

🎙 Halftime Snacks Podcast

Content Creation and Sports Business Journalism at Sportico

Jacob is a sports business reporter at Sportico and has +10 years of experience writing for brands in sports such as the NFL, Boston Globe, the Washington Post, and Sports Illustrated.

Sportico is a digital content and media company that brings high-quality data, information, news, and strategy from what’s hot and relevant in the sports business.

We discussed the evolution of content and media in sports, Jacob’s process, style, and tactics for writing, sports journalism, Sportico, and what the industry needs in the future.

Listen here:

If you’re not yet a subscriber, sign-up for free to receive new Sports-Tech Biz posts every Friday: